10 modern and easy ways to invest in real estate that nobody tells you

Real estate investing may seem like a difficult task to many common people. But with the right guidance, knowledge, and support, real estate investing can be very rewarding and a much easier process than it seems. Generally, it is believed that investing in real estate requires a lot of capital, experience, connections, and skills. But in reality, anyone with the right mentality and disciplined approach can become a highly successful real estate investor and be very successful in it. After reading this article you will get to know-

Why should in Invest in real estate? How to invest in real estate?

Why You should invest in real estate in 2023?

The most important question you should ask is why are you investing in real estate or what are the benefits. Real estate investment is one of the most profitable investment methods which gives a high return on investments. And investing in properties or buildings is a potential source of passive income. It doesn’t require constant monitoring when compared to similar investment methods like stocks and shares. Since the risk level is significantly low, the sense of security that real estate investment provides is unmatchable. Since inflation is one of the hot topics among finance professionals and investors, historical data and future predictions show that real estate is one of the very few potential investment methods which can beat inflation.

In real estate, you have control over the property you investing and you can control the expenses and manage the property so that you can maximize the return. This level of control and flexibility is not offered by any other investment methods. The majority of high-return investment methods like stocks, shares, and mutual funds are subjected to market risk, which is beyond your control.

How to invest in real estate?

Since you understand the importance and benefits of investing in real estate, you may think about how to invest in real estate and which are the best available ways. Well, the answer is, there are several ways to invest in real estate based on several factors such as-

· Your capital for investment.

· Risk you are willing to take.

· Amount of time you are willing to spend.

· Kind of property you want to own etc.

Once you figure out the answers to all these questions, then you can easily select the right method for investments. Here are some of the popular and easiest ways to set foot in the real estate industry.

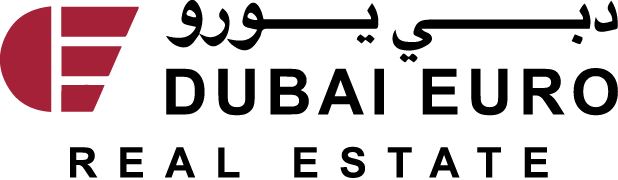

- 1. Real estate investment trusts. (REITS):

REITs are companies that are investing in real estate. These companies allow the public to invest in their companies. So, by investing in REITs, you are investing in real estate. The benefits of investing are beyond what you may think. You can start investing in real estate with a very minimum amount. This is beneficial for people who can’t raise huge capital. There are several companies that offer investment in really low capital. Investing in REITs has high liquidity (one of the drawbacks of real estate.) Even though you don’t have any real estate knowledge, investing in REITs is easy as REITs are managed by experienced real estate professionals.

Visit https://reit.ae/ for more.

Benefits of REITS.

Benefits of REITs

- Opportunity to invest in real estate at a lower cost than the cost of owning a property.

- Doesn’t need in-depth knowledge about real estate.

- Managed by Professionals.

- Liquidity.

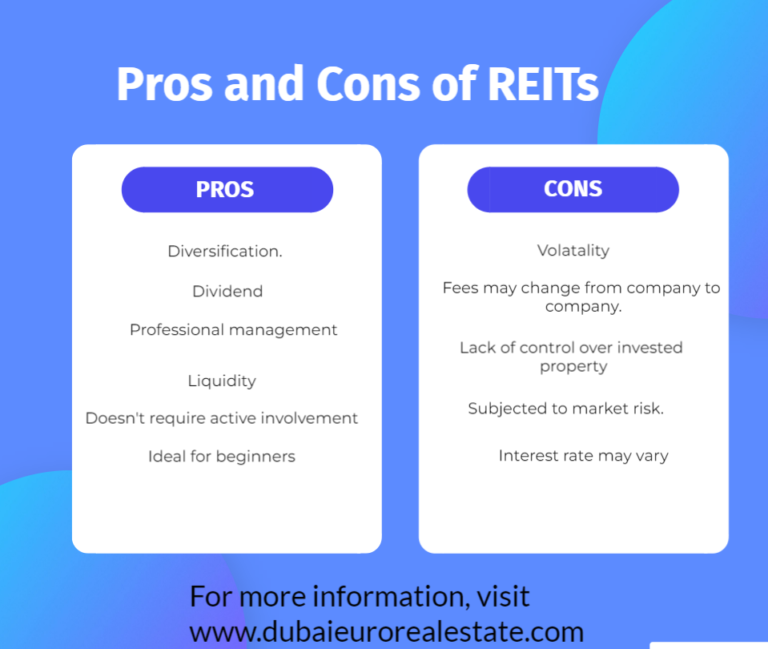

2. Online marketplaces.

Due to technological advancement, there are so many online portals where you use to invest in real estate. If you have basic real estate knowledge, then these platforms will be helpful. Different from traditional real estate processes, these online platforms will really ease the process. It also lets investors invest in a diversified portfolio across multiple properties and regions. It will eliminate the risk of losing in single property or area.

Benefits of Online Marketplaces.

- Advanced and easy way to search and compare properties.

- Global reach.

- Faster transactions and fewer delays.

3. Crowdfunding investments.

Crowdfunding investments are also one of the modern investment methods in which you can easily invest in real estate. It is the method of investing in real estate by pooling large sums from different investors.

Crowdstreet and RealtyMogul are some of the top real estate crowdfunding investments.

https://www.crowdstreet.com/ ,

Benefits of Crowdfunding Investments.

- Higher capital provides access to high-quality investments.

- Potential for high returns

- Lower investment minimums compared to traditional methods.

4. Rental properties

Investing in rental properties can be a relatively easy way to get started in real estate. It can provide you with a stable secondary income. It is better to use a property management company to handle the day-to-day operations. Apart from the rental income, you will also get the benefit of capital appreciation.

Benefits of Rental Properties.

- A potential source of passive income.

- Potential for long-term investment.

- Satisfaction of owning a tangible asset.

- Provides tax benefits such as the ability to deduct mortgage. (it is subjected to the tax of of your jurisdiction)

5. Joint ventures and Partnerships.

Joining hands with more experienced professionals or real estate investors can provide you with better opportunities in real estate. You will get exposure to potential deals. If you are a newbie to the real estate industry, then this is an ideal way to kick off. You can also learn the business from them. It will also reduce the financial burden and increase the chance of success. Keep in mind that your partner must be trustworthy.

Benefits of Joint ventures and Partnerships.

- Allows multiple investors to pool money and combine their expertise, which provides better access to better deals.

- Responsibilities, workloads, risks, etc. are shared, which will help to get peace of mind.

6. Real estate mutual funds.

It is similar to any other mutual fund investment. You will get the benefit of diversification, liquidity, dividend, convenience, affordability, etc. On the other hand, it also carries certain risks too. As investments, Mutual funds are always subjected to various market risks and economic conditions. You don’t have much control over the properties they are investing in. Fees and expenses are one of the factors that make mutual funds less favorable.

Benefits of Real estate mutual funds.

- Diversification is a vital benefit of mutual funds in real estate. It allows you to invest in multiple properties and reduce the risk associated.

- It is so affordable that you don’t need to raise huge capital to invest in real estate.

- Your funds are managed by professionals who have the expertise and in-depth knowledge of the industry.

- Simplicity is one of the benefits of investing in mutual funds. Due to technological advancements, the procedures are streamlined to conduct in a faster and better way.

7. Real Estate Investment Accounts. (REIA)

Real estate investment accounts also known as real estate savings account is a type of investment method that allows individuals to invest in real estate without the need for direct ownership of the property. It is similar to traditional savings accounts as they offer a fixed rate of return. The difference here is, instead of depositing into an account, the money will be invested into a pool of real estate investments managed by financial institutions. Along with safety, the low entry barrier is one of the main attractions of REIA. The risk and return for REIA are low compared to the previous methods. If safety is your primary concern, then this method will suit you more.

Benefits of REIA

- Real estate investment accounts also provide the opportunity for diversification which enables reduced risks.

- The process is much simpler that you can invest in REIA with ease. Low entry barriers are one the main attraction of REIA.

8. Real estate index funds. Real estate index funds are a type of real estate mutual fund or an exchange-traded fund that invest in real estate investment trusts (REITs). As we already learn what is REITs, investing in a real estate index fund is my least recommendation. Though it offers benefits like diversification, liquidity, lower costs, professional management, etc. the prime aim of every investment is the maximum return. Since we are not investing directly, there are always management fees and it can reduce the overall returns. Also, this kind of investment plan is subjected to market risks.

Benefits of Real estate index funds.

- The potential for higher return is one of the many benefits which make real estate index funds a favorite to real estate investors.

- Investors need to spend so much time for research and analyzing individual properties.

- No need for active involvement to manage the properties.

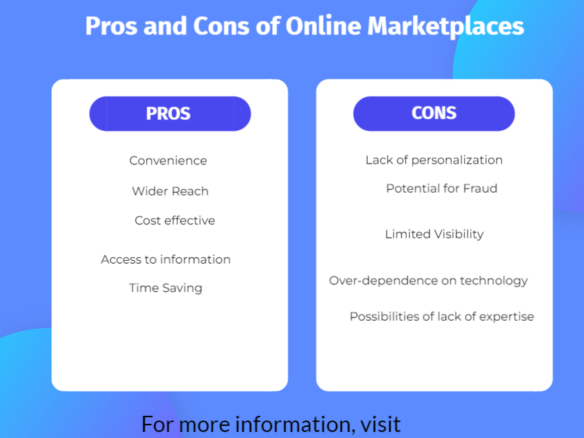

9. Real estate notes. Real estate notes are referred to the promissory notes that are secured by real estate. They are a form of debt investment in which an investor provides financing to a borrower in exchange for regular payments and returns the principal amount at the end of the loan term. Investing in real estate notes can be a way for investors to generate income from the loan payments made by the borrower. Real estate notes can offer high returns compared to traditional investments such as bonds or stocks, and also offers the potential for capital appreciation.

Benefits of Real estate notes.

- Real estate investment notes give control over the terms and conditions of their investments, as they can negotiate the interest rate, payment frequency, and, other aspects of the investment directly with the borrower.

- Real estate notes can provide investors with the potential for appreciation as the value of the underlying real estate assets increases over time.

- Real estate notes can offer investors the potential for higher yields compared to other investment options, such as bonds or savings accounts, as they are often backed by real estate assets.

10. Real estate rent-to own If you are a person who has in-depth knowledge about the real estate industry and capital is the only thing that holds you back, then rent to own is the best suitable method for you. It is a real estate transaction in which tenants rent a property with the option to purchase it later, usually after a period of time. Generally, the tenant has to pay a higher rental rate than the market value. But the advantage here is, a portion of the rent goes to the down payment for the purchase of the property.

Benefits of Real estate rent-to own

- For tenants, a RTO arrangement provide an opportunity to become a homeowner over time, as they can make rental payments that accumulate towards a down payment on the property.

- RTO arrangements can provide the benefits of having a tenant responsible for maintaining the property and paying the rent, which can be a source of income.

These are some of the easiest and most affordable ways to enter into the real estate industry. Before entering into it, don’t forget to acquire as much in-depth knowledge about the industry. There are several factors to consider before investing in real estate. Here are the 10 Factors you need to study before investing in real estate.